NEWS

Incremental Business from Data Monetization

The phrase, “Data is the New Oil” is widely used but how are companies actually using data to create new revenue streams? This mobileVision Insight explores how data is commercially exploited and explains what companies should do when considering data monetization...

Digitization of Marketing – a post Covid-19 Boost

Marketing budgets looked very different for many companies at the beginning of 2020 than they do now. Following the COVID-19 outbreak, everything changed. According to Gartner more than 44% of CMOs reported midyear budget cuts as a result of the pandemic, and...

Digital Portfolio Optimization

In 2018/2019 corporations have spent in average 36% of their investment budget in digital initiatives, some even up to 50%! However, more and more executives state they require “more digital bang for less buck”. It might well be time for Digital Portfolio...

Digital Customer Care Best Practices

A recent mobileVision study has revealed that Digital Customer Care is on the strategic priority agenda for corporations. Consumers increasingly prefer digital interactions when...

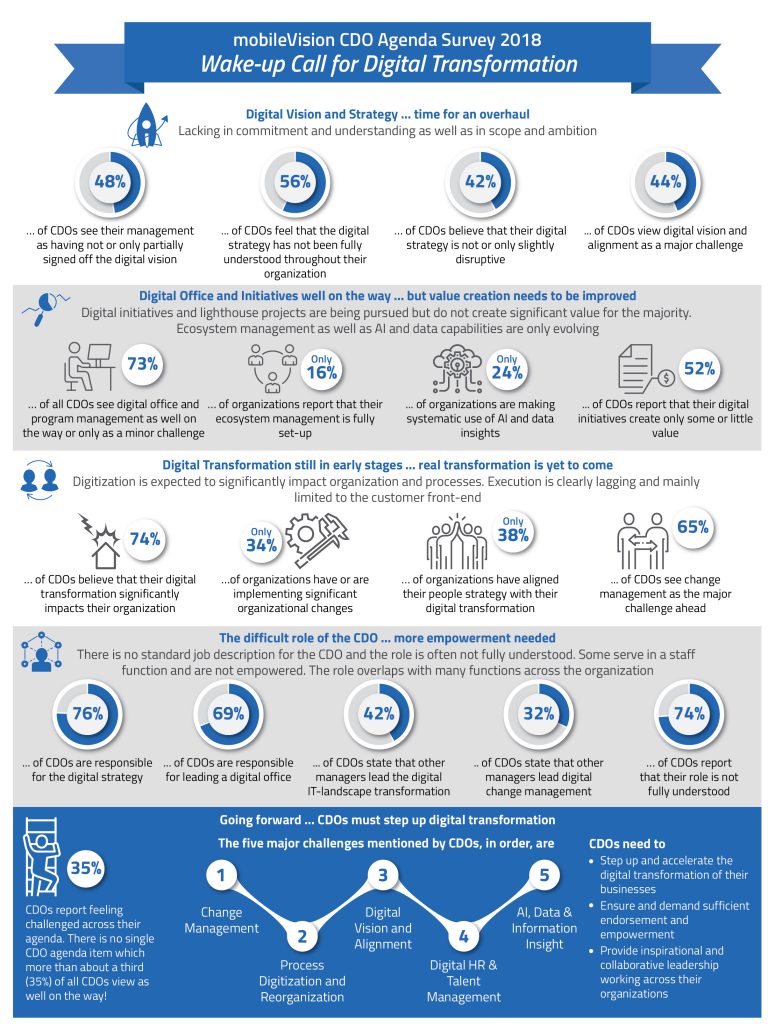

mobileVision’s Digital 12 CDO Agenda Survey

Executive Summary Our mV insights CDO Digital-12-Agenda Survey 2018 reviewed CDO’s status along mobileVision's CDO agenda pyramid. While good progress has obviously been made, the results also show that in early 2018 there remains a lot to be done on the way to a...

APIs – The Heroes of Digital Business

APIs are the connective fabric in today’s digital ecosystems. For companies who know how to develop an API strategy and implement and leverage them, they can cut costs, improve efficiency - and open new pathways to innovation and growth! APIs have been...

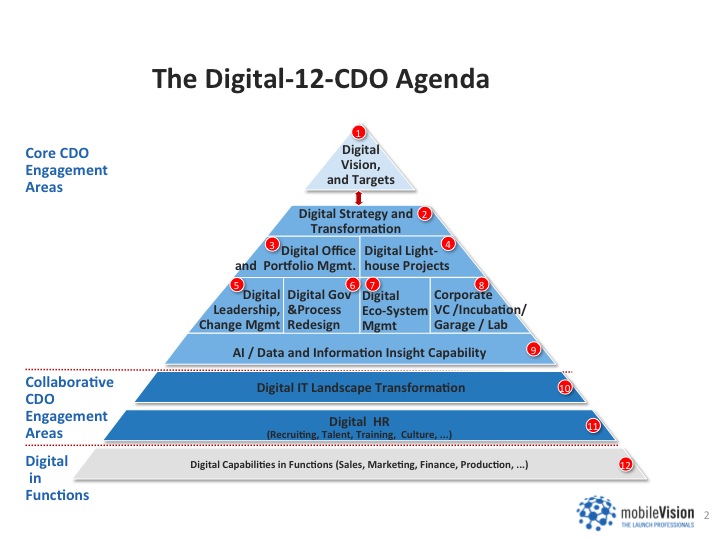

The Digital-12-CDO Agenda

Digital Transformations lead corporations to create the role of a Chief Digital Officer. Our engagements reveal that fully functioning CDOs need to own a Digital-12-Agenda to master the digital transformation...

PLEASE FEEL FREE TO EXPLORE OUR PRESS RELEASES AND NEWS

Contact

mobileVision GmbH

Farchanter Strasse 28

81377 Munich

Germany

Tel: +49 172 3884444

Fax: +49 89 54779222

Email: info[at]mobilevision-group.com

RECENT POSTS

Incremental Business from Data Monetization

The phrase, “Data is the New Oil” is widely used but how are companies actually using data to create new revenue streams? This mobileVision Insight explores how data is commercially exploited and explains what companies should do when considering data monetization for...

Digitization of Marketing – a post Covid-19 Boost

Marketing budgets looked very different for many companies at the beginning of 2020 than they do now. Following the COVID-19 outbreak, everything changed. According to Gartner more than 44% of CMOs reported midyear budget cuts as a result of the pandemic, and nearly...

Digital Portfolio Optimization

In 2018/2019 corporations have spent in average 36% of their investment budget in digital initiatives, some even up to 50%! However, more and more executives state they require “more digital bang for less buck”. It might well be time for Digital Portfolio...

Digital Customer Care Best Practices

A recent mobileVision study has revealed that Digital Customer Care is on the strategic priority agenda for corporations. Consumers increasingly prefer digital interactions when...

mobileVision’s Digital 12 CDO Agenda Survey

Executive Summary Our mV insights CDO Digital-12-Agenda Survey 2018 reviewed CDO’s status along mobileVision's CDO agenda pyramid. While good progress has obviously been made, the results also show that in early 2018 there remains a lot to be done on the way to a...